Introduction to the History of Currency

Imagine a world without money—no bills in your wallet, no coins jingling in your pocket, and certainly no digital payment apps at your fingertips. It’s hard to picture, isn’t it? But once upon a time, humans lived in such a world. To truly understand how we got from bartering chickens for grain to scanning QR codes at coffee shops, we need to step back in time and explore the fascinating origins of currency.

The Spark That Started It All

The story begins with barter—a system that worked well enough when people lived in small communities. You had extra wheat; your neighbor had surplus fish. Trade was simple. But as societies grew larger and trade networks expanded, calculating the value of goods became messy. Enter the first solution: commodity money. Items like salt, shells, and even cocoa beans became the earliest “cash,” valued because they were useful or rare.

- A Roman soldier would receive his salary in salt (hence the word “salary”).

- The Aztecs treated cocoa beans like tiny edible treasures.

- In some cultures, polished stones were worth fortunes.

Eventually, the inefficiencies of hauling bags of salt or bundles of shells dawned on early civilizations. And so, humans made a leap that changed history forever: the invention of metal coins.

The Rise and Fall of Coins and Paper Money

The Glittering Age of Coins

Oh, the clink of coins in your pocket! For centuries, metals like gold, silver, and copper carried the weight of commerce. Coins weren’t just currency—they were symbols of power, wealth, and trust. Imagine a Roman soldier’s pay pouch filled with gleaming denarii, or a medieval merchant weighing stacks of Venetian ducats on a scale. Each coin told a story: empires rose, fell, and left behind glimmers of their legacy etched in metal.

But as trade grew, bags full of heavy coins became, well, *a bit much*. Transporting them over long distances was risky—and let’s be honest—no one wants to carry the equivalent of a gym bag to buy bread. Enter paper money, a lightweight revolution inspired by 7th-century China. What started as fragile slips of silk and bark evolved into the detailed, colorful banknotes we know today.

- The U.S. dollar: A trusted global powerhouse since the late 1700s.

- The Deutsche Mark: A post-war icon of Germany’s recovery.

- The British Pound: The sturdy backbone of centuries of trade.

From Bills to Obsolescence

But here’s the twist: what shot to fame can also fade just as fast. Coins began slipping out of favor as inflation eroded their value—who uses a penny anymore? Paper money, once prized, faced its own decline as it became easier to counterfeit and harder to secure. The rise of plastic cards and digital payments signaled the beginning of the end for some currencies.

Look around today: how often do you fish out bills compared to tapping your phone at checkout? Despite their downfall, coins and paper money still evoke nostalgia, charm, and an undeniable tactile magic. Yet, like faded Polaroids or handwritten letters, their time seems to be slipping through our fingers.

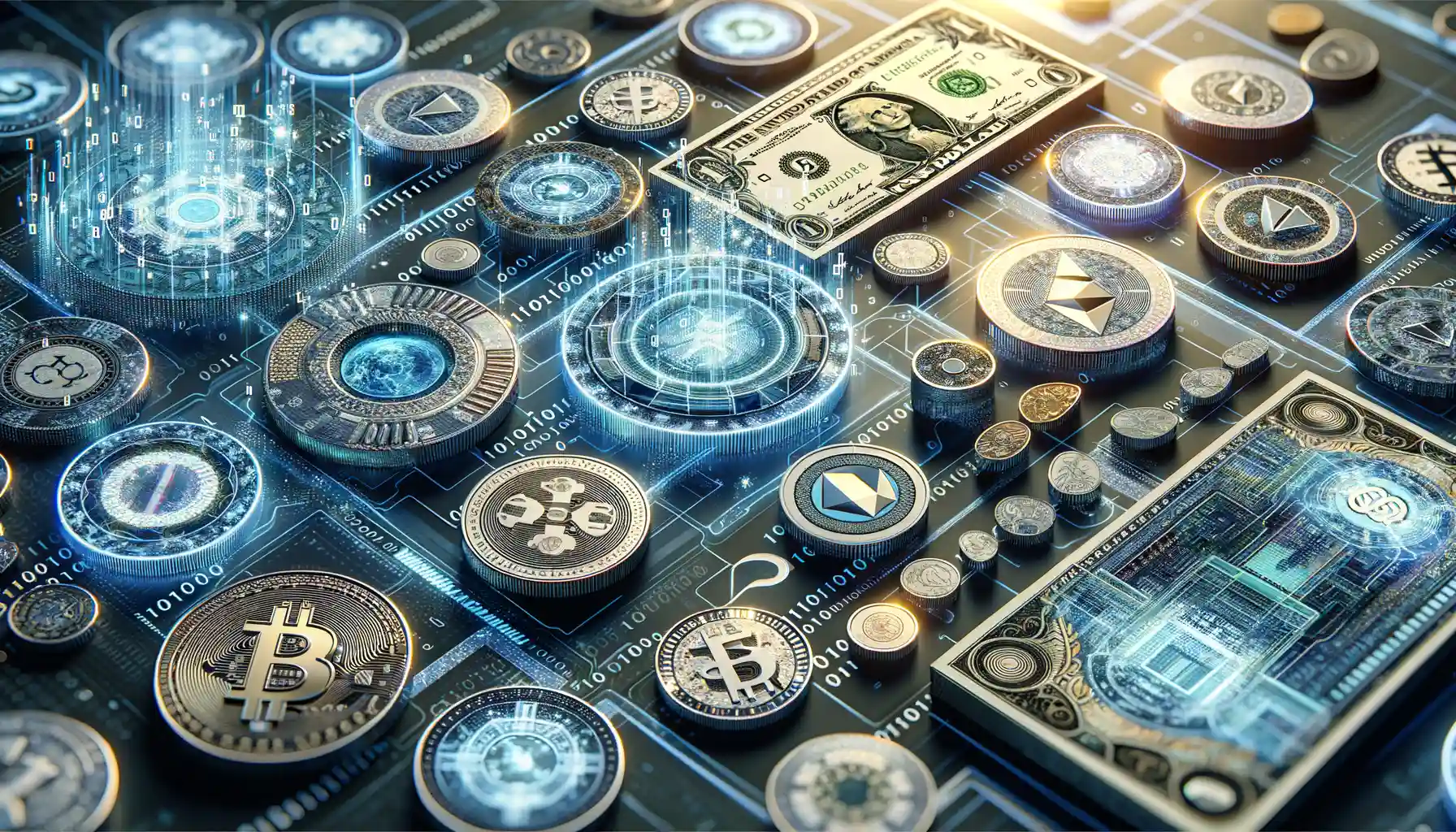

The Emergence of Digital and Cryptocurrency

The Spark of a New Financial Era

Picture this: a world where your wallet is no longer weighed down by coins or stuffed with crumpled bills. Instead, your entire financial life exists as a collection of ones and zeroes, zipping through networks at lightning speed. This isn’t the distant future—it’s here and now, thanks to the rise of digital currency.

For years, money was tangible—a gold coin pressed into your palm, a crisp note traded for goods. Then came the dawn of the digital revolution. Enter trailblazing technologies like credit cards, PayPal, and eventually, the game-changer: cryptocurrency.

Unlike traditional currencies tied to governments, cryptocurrencies such as Bitcoin and Ethereum operate peer-to-peer, bypassing middlemen like banks entirely. Think of it as trading directly with a neighbor, only on a global scale.

- Transparency: Blockchain technology ensures that every transaction is visible and immutable.

- Decentralization: No single entity controls the currency—it’s power to the people.

- Security: Cryptography safeguards your valuable digital assets.

Truly, we’ve stepped into an era where money is no longer something you hold—it’s something you experience in real-time, across borders, with just a few clicks. Who would’ve guessed that the essence of value would one day become…virtual?

Why Cryptocurrency Took Off Like Wildfire

Let’s be honest, traditional systems haven’t always kept pace with the needs of modern humans. Slow international transfers, bank fees nibbling away at savings, and economic instability—all were cracks in the old foundation. Then came Bitcoin in 2009, the rebellious pioneer offering an irresistible alternative.

Suddenly, people realized they could own money free from government control. They could send funds overseas without delays or ridiculous fees. And those early adopters who mined Bitcoin on their laptops? Some became millionaires practically overnight!

But the ride wasn’t smooth. Cryptocurrencies have had more ups and downs than a rollercoaster. Scandals, skepticism, and fluctuating prices cast doubt on their viability. Yet, despite the turbulence, the concept stuck—and evolved. From online purchases to NFTs to entire economies embracing blockchain, we’re watching history unfold.

What once was a curiosity reserved for tech geeks has grown into a phenomenon reshaping how the world sees money. Can you feel it? The world is turning digital, and currency is riding the wave.

Impacts of Digital Currency on Modern Economy

Unlocking Financial Freedom: The Ripple Effect of Digital Currency

Step into the bustling marketplace of the 21st century, and you’ll see how digital currency has flipped the traditional economy on its head. Gone are the days when cash ruled—and in its place, intangible yet powerful bits and bytes now fuel commerce. But what’s the real impact? Let me paint you a picture.

For millions of unbanked people worldwide, digital currencies like Bitcoin or Ethereum aren’t just techy trends—they’re lifelines. No bank account? No problem. All you need is a smartphone and an internet connection, and suddenly, even the farmer in a remote village can trade with a tech startup in Silicon Valley. It’s as if someone quietly opened the financial floodgates.

And businesses? They’re breaking barriers too. Cross-border transactions that once felt like slow-motion chess now happen at lightning speed, with fees that won’t make your wallet weep. Here’s why companies are loving the shift:

- Faster payments powering global business.

- No middlemen: goodbye hefty transaction fees!

- Decentralization reduces fraud risks (a win for everyone).

But this change isn’t all roses. Traditional banking systems are grappling with disruption, much like a taxi service watching Uber take over their streets. The balance of power is shifting—and fast.

Reshaping Consumer Habits and Financial Decision-Making

Have you noticed how people behave differently when they don’t touch physical money? With digital wallets, spending feels almost… frictionless. That $5 coffee? Swipe. Another streaming subscription? Tap. Easy, but sometimes dangerous—digital currency turns money into pixels, sometimes making it feel less *real*.

Yet, fascinatingly, it also encourages smarter saving. Apps tied to cryptocurrencies let users track investments in real time. Imagine opening your phone to see your money grow because you bought 0.01 Bitcoin during a dip. It’s gamified finance—a new playground for the savvy.

In short? Digital currency is rewriting the rulebook of how we earn, spend, and think about money. And whether you’re ready or not, the revolution is already at your doorstep.

Future Trends in Currency Development

The Dawn of Programmable Money

The future of currency isn’t just digital—it’s *smarter*. Imagine money that can think, act, and follow rules you set. That’s where we’re headed with the rise of programmable money. Powered by technologies like blockchain and smart contracts, these currencies won’t be passive funds sitting in your account. Instead, they’ll work on your behalf.

Picture this: rent payments that automatically transfer to your landlord on the first of the month—no reminders needed. Or funds that won’t process unless a supplier meets strict quality standards. This isn’t science fiction; it’s already happening with projects like Ethereum setting the stage. But here’s the kicker—it’s not only about convenience. Programmable money has the power to rebuild trust and transparency into financial transactions.

- Decentralized currencies that eliminate middlemen.

- Financial tools designed to combat fraud and misuse.

- Cross-border payments that occur in seconds, not days.

The Merge of Virtual and Physical Economies

Another fascinating trend is the blending of financial worlds. The line between the digital and physical economies is beginning to blur. With metaverse platforms like Decentraland and Roblox introducing their own thriving virtual currencies, what’s to stop the concept from bleeding into everyday life? Soon, you might be buying groceries using currency earned from selling virtual real estate!

Take loyalty points as an example. They’re essentially mini-currencies already, aren’t they? Now imagine them being tradable across businesses—your coffee rewards paying for your next Uber ride. It’s not far-fetched when considering the growing integration between tokenized assets and daily transactions. It’s all transforming the way we see—and spend—our money.